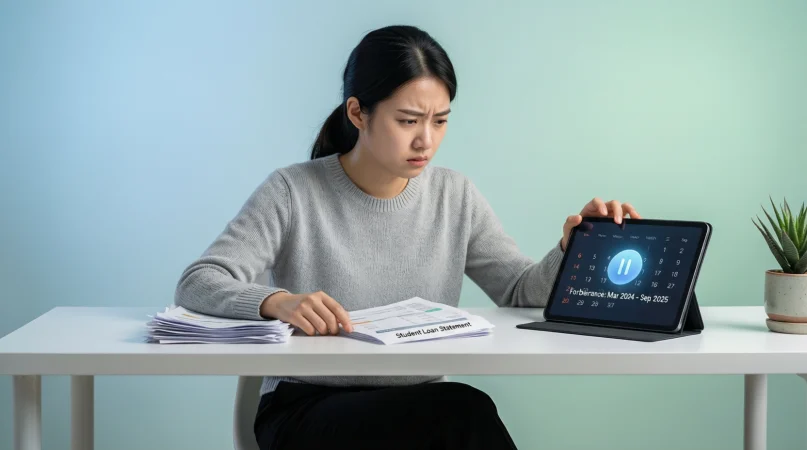

Forbearance in student loans means a temporary pause or reduction in your loan payments that your lender allows during financial hardship, while interest usually continues to accrue.

Feeling overwhelmed by student loan payments and hearing the word forbearance everywhere? You’re not alone. For many borrowers, forbearance can feel like a financial lifeline or a confusing trap depending on how it’s used. Understanding exactly what forbearance means in student loans can help you make smarter decisions, avoid costly mistakes, and protect your financial future.

Let’s break it all down in plain English, step by step.

What Does Forbearance Mean in Student Loans?

In the context of student loans, forbearance is a short-term relief option that lets you temporarily stop making payments or make smaller payments when you’re struggling financially.

Unlike forgiveness or cancellation, forbearance does not erase your debt. It simply gives you breathing room.

In simple terms:

- You don’t have to make full payments for a limited time

- Your loan does not go away

- Interest usually keeps adding up

- You’ll likely owe more later if interest capitalizes

Think of forbearance like hitting the pause button, not the stop button.

Why Student Loan Forbearance Exists

Student loan forbearance exists to protect borrowers during temporary financial stress, such as:

- Job loss

- Medical emergencies

- Reduced income

- Natural disasters

- Military service

- Unexpected life events

It helps borrowers avoid default, which can seriously damage credit and lead to wage garnishment or collections.

Origin and History of Student Loan Forbearance

The term forbearance comes from Middle English forberen, meaning to restrain or hold back. In finance, it evolved to mean a lender voluntarily refraining from enforcing payment.

In student loans:

- Forbearance became more common in the late 20th century

- Gained massive attention during the COVID-19 student loan payment pause

- Is now widely searched due to rising tuition costs and loan balances

Today, forbearance is one of the most frequently discussed student loan relief options online.

How Student Loan Forbearance Works

Here’s what typically happens when you request forbearance:

- You apply through your loan servicer

- Your servicer reviews eligibility

- Payments are paused or reduced

- Interest continues to accrue

- Forbearance ends after a set period

⏱️ Most forbearance periods last up to 12 months at a time, with limits on total usage.

Types of Student Loan Forbearance

There are two main types of forbearance:

1. General (Discretionary) Forbearance

Approved at your loan servicer’s discretion.

Common reasons include:

- Financial hardship

- Medical expenses

- Employment issues

- Temporary income loss

📝 Usually granted in 12-month increments

2. Mandatory Forbearance

Your servicer must approve this if you meet specific criteria.

Examples include:

- AmeriCorps service

- Medical or dental residency

- National Guard service

- High student loan debt relative to income

Does Interest Accrue During Forbearance?

Yes—almost always.

Interest rules:

- Subsidized federal loans: Interest may be covered in limited cases

- Unsubsidized federal loans: Interest accrues

- Private student loans: Interest accrues

⚠️ If unpaid, interest may capitalize, meaning it gets added to your principal balance—causing you to pay interest on interest later.

Example Table: How Forbearance Affects Your Loan

| Scenario | Monthly Payment | Interest Accrual | Balance Impact |

|---|---|---|---|

| Normal repayment | $350 | Yes | Stable |

| Forbearance (6 months) | $0 | Yes | Balance increases |

| Forbearance + interest payments | $0 | Reduced | Less balance growth |

| Deferment (subsidized loan) | $0 | No | Balance stays same |

Real-Life Examples of Forbearance Usage

Friendly / Practical Tone

“I used student loan forbearance after losing my job. It helped me stay afloat while I found new work.”

Neutral / Informational Tone

“Borrowers may request forbearance during periods of financial hardship, subject to lender approval.”

Negative / Cautionary Tone

“Relying on repeated forbearance can significantly increase total loan costs due to compounded interest.”

📌 Emoji note: Some financial blogs use ⚠️ or 💸 to emphasize warnings—but professional tone usually avoids overuse.

Forbearance vs Deferment

Many borrowers confuse forbearance with deferment, but they’re not the same.

Comparison Table

| Feature | Forbearance | Deferment |

|---|---|---|

| Payments paused | Yes | Yes |

| Interest accrues | Usually yes | Sometimes no |

| Eligibility | Easier | Stricter |

| Cost over time | Higher | Lower |

| Best for | Short-term hardship | Specific life events |

💡 Rule of thumb:

If you qualify for deferment, it’s often better than forbearance.

Forbearance vs Income-Driven Repayment (IDR)

Another common comparison:

Forbearance:

- Temporary

- Interest builds up

- No progress toward forgiveness

Income-Driven Repayment:

- Payments based on income

- Can be as low as $0

- Counts toward loan forgiveness

👉 IDR is usually a better long-term option than repeated forbearance.

When Should You Use Student Loan Forbearance?

Forbearance makes sense if:

- Your hardship is temporary

- You expect income to recover soon

- You need immediate relief

- Other options aren’t available

Avoid forbearance if:

- Financial issues are long-term

- You qualify for IDR or deferment

- You’re close to loan forgiveness

Alternate Meanings of Forbearance

Outside student loans, forbearance can also mean:

- A legal agreement delaying foreclosure

- A personal choice to show restraint or patience

- A lender delaying debt enforcement

However, in student loans, it almost always refers to temporary payment relief.

Professional and Polite Alternatives to Forbearance

Instead of saying:

- “I’m in forbearance”

You could say:

- “My student loans are temporarily paused due to financial hardship.”

- “I’m using a short-term loan relief option.”

- “My lender approved a temporary payment suspension.”

These sound more professional and neutral, especially in work or legal contexts.

Common Mistakes Borrowers Make with Forbearance

⚠️ Avoid these pitfalls:

- Using forbearance repeatedly without a plan

- Not paying interest when possible

- Assuming loans are forgiven

- Forgetting when forbearance ends

- Ignoring better repayment options

FAQs

1. Does forbearance hurt your credit?

No as long as it’s approved. Missed payments without approval can hurt your credit.

2. Is student loan forbearance bad?

Not inherently. It’s helpful short-term but expensive long-term if overused.

3. How long can student loan forbearance last?

Typically up to 12 months at a time, with cumulative limits.

4. Do payments count toward forgiveness during forbearance?

Usually no, unless special government programs apply.

5. Can private student loans be put in forbearance?

Yes, but terms vary by lender and are often stricter.

6. What happens when forbearance ends?

Payments resume, and any unpaid interest may be capitalized.

7. Should I pay interest during forbearance?

If you can yes. It reduces long-term costs.

8. Is forbearance better than default?

Absolutely. Default has severe financial and legal consequences.

Conclusion

It means temporary relief not forgiveness.

Forbearance can be a powerful safety net during tough times, but it’s not free money. Used wisely, it can protect your credit and give you breathing room. Used carelessly, it can quietly inflate your debt.

The smartest borrowers treat forbearance as a bridge, not a destination and always pair it with a clear repayment plan.

Olivia Brooks is a skilled writer at ValneTix.com dedicated to making word meanings simple, practical and relatable. Her clear explanations empower readers to use language effectively and confidently.